How to outperform 80% of all the Hedge Fund Managers on Wall Street

The Truth about Hedge Fund Managers and Wall Street

The financial services industry is built on two forces: greed and fear. On one hand, its not surprising to see people appear to make millions overnight with a series of smart trades. There's always that one guy at work who brags about how he made a killing because he got into Tesla or Google or something early on and made 10x on his investment. The appeal is understandable-- it seems easy, and in hindsight, you should have known better. |

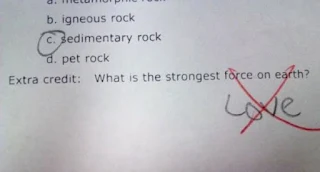

| I'm so confused |

The truth of the matter is most of these investment houses make more money off of *you* moreso than off the stock market. The typical hedge fund manager charges 2% "asset management fee". If he makes money for you, he takes an additional 20% off the top. If he loses money, then its because of market volatility and he still takes the 2% management fee anyways. Its an unfair game and its only going to get um... unfairer.

This system would be all well and good and I wouldn't complain one bit if the hedge funds and mutual funds actually made money for you. But in reality, most hedge fund managers and mutual funds fail to even match the market, let alone beat it.

To put it in another way, if you had the names of all the 500 stocks in the S&P 500 listed on a wall, and you had a trained monkey choose 40 different stocks by throwing a 40 darts at the wall, those 40 stocks would track the S&P 500 index by within 3 percentage points. That means that a trained monkey will outperform a typical hedge fund manager, and that's before accounting for fees!

|

| It helps if the monkey was trained at Columbia |

So what exactly are you paying for with these hedge fund managers? You're paying them to potentially get you market crushing returns and but to also give you peace of mind as they handle all the crazy fluctuations. Again, greed and fear.

The House Always Wins

The most effective strategy that requires the minimum of work is to simply invest on the whole market.Take the greed and fear out of the equation. Regularly make a contribution to your 401(k), IRA, or equivalent every month and don't think too much about it. Obviously there will be recessions and dips, but if you have the mindset of making a decade-long investment, then time has a way of smoothing out all those squiggly lines. In fact, if you take a long term approach and adjust for inflation, the S&P 500 will give you an average annualized return of about 7%.

There exist index funds, such as the Vanguard S&P 500 Fund that charge miniscule expenses in order to take care of overhead. Their sole job is to track the holdings of the S and P 500 index. There's no hedge fund calling the shots, no trained monkey. Its simply a fund that tracks all 500 companies in the S&P 500.

In addition to minimal expenses ratios and waived commissions, many of these funds will also let you invest as little as 100 dollars at a time (some even 1 dollar at a time!).

Using The most powerful Second Most Powerful Force on Earth to your Advantage

|

| you don't need no credit card to ride this train |

|

| Stocks are on sale! |

Likewise, the stock market is the same way. When the market corrects and takes a nosedive, think of it as everything being on sale. And while the prices are depressed, the rate of return of the stock market actually increases. In fact, those who kept regularly investing money during the great recession have been enjoying a rate of return north of 13% for the past 6 years. The reason simply being that everything was 50% off during 2009 and just now, in 2015, everything has pretty much returned to its normal prices.

Sticking to the System

Don't be fooled. These fund managers will use greed and fear in order to rope you into their actively manged funds. And while you're in the system they will bleed you dry with their exorbitant management fees. By simply sticking to the simple system and investing in the "house" as opposed to trying to beat it, then you will out perform most of these hedge fund shysters. Because, math.Further Reading:

Invest like Warren Buffett: Buy and Hold

Dollar Cost Averaging

S&P 500 Return Calculator

88% Of Hedge Funds, 65% Of Mutual Funds Underperform Market In 2012